With the market enjoying a significant rally for the past two months following a big downturn in the market at the beginning of the year, I’m reminded of a statement made to me years ago by a worried investor: “The market is just a big gamble, like a casino.”

It is true that the market can gyrate up and down, and it is true that the movements can appear to be random, and it is also true that we tend to remember our losses more than our gains. However, I want to explain (just as I did to the worried investor years ago) why the stock market is NOT like a casino.

At the casino every game carries long-term odds that are in the house’s favor. Of course, you can win at the casino in the short run–if you are lucky and/or good. But–and this is the key–if you play long enough, the casino will end up with your money. It’s just the nature of things when the odds are stacked against you.

The stock market is different and may actually be thought of as the opposite of the casino. In the short run it’s about 50-50 whether you will “win or lose.” But in the long run, the odds increase in your favor dramatically.

So, in the long run, you are likely to end up more money, whereas in the casino, you are likely to end up with less (or none) of your money. This is why we at The Planner’s Edge stress having a long-term time horizon for your investments. The longer your money is exposed to the ups and downs of the market, the greater your odds of significant success.

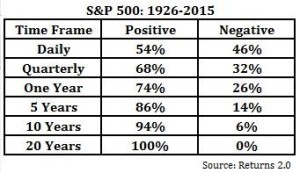

Below is a chart that provides a clear and powerful illustration of this concept over the past 89 years for the SP500 index. It is provided by Ben Carlson’s website: www.awealthofcommonsense.com/playing-the-probabilities/.

Carlson’s chart explains that daily performance for the SP500 index has been positive 54% of the days—so it’s almost a 50-50 proposition.

But watch how positive performance increases dramatically, if you look at quarterly results; it’s been positive 68% of those quarters. Annual performance is positive 74% of the years. And if your time horizon is 5 years, you have seen positive results 86% of the time. If it is 10 years, it is approaching 94% certainty that your results will be positive. Finally, all 20 years periods from 1926 through 2015 have provided positive returns.

As I explained above, not only is the market not like a casino, it can thought of correctly as the opposite of a casino.

Jeffrey Ross

Registered Investment Advisor

The Planner’s Edge

FORWARD LOOKING STATEMENT DISCLOSURE

As a Registered Investment Advisor, one of our responsibilities is to communicate with clients in an open and direct manner. Insofar as some of our opinions and comments are based on current advisor expectations, they are considered “forward-looking statements” which may or may not be accurate over the long term. While we believe we have a reasonable basis for our comments and we have confidence in our opinions, actual results may differ materially from those we anticipate. You can identify forward-looking statements by words such as “believe,” “expect,” “may,” “anticipate,” and other similar expressions when discussing prospects for particular events and/or the markets, generally. We cannot, however, assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Further, information provided in this letter should not be construed as a recommendation to purchase or sell any particular security.

The Planner’s Edge®: TM & copyright 2013. All rights reserved. No part of this publication may be reproduced in any form, or by any means whatsoever without written permission from the publisher. Serious Money TalksTM is a trademark of The Planner’s Edge®. If you would like further information about the services of The Planner’s Edge®, please call 206-232-4500 or 1-800-735-7302. Email: info@theplannersedge.com.