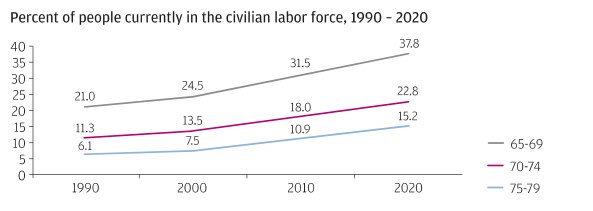

I came across new data about our changing work and retirement habits, showing that in the two decades between 1990 and 2010, older Americans have increasingly continued working. The percentage of 65-69 year-olds in the labor force has increased from 21% to 31.5%. The percentage of 70-74 year-olds has increased from 11.3% to 18%. Even the percentage of 75-79 year-olds has increased from 6.1% to 10.9%. All three age groups are projected to increase their respective percentages even more by the year 2020.

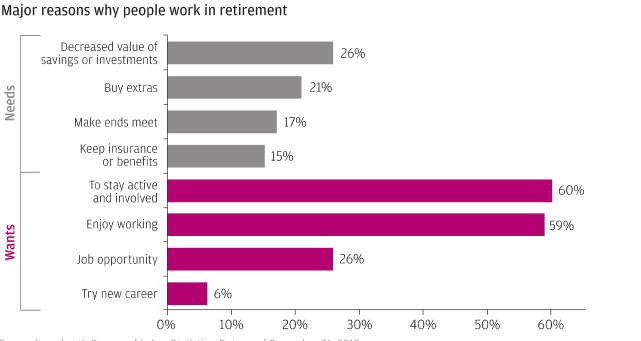

There is no single reason why we are working well into what has previously been thought of as our retirement years, but this graph shows the primary reasons:

Clearly, some people continue working out of financial need (to keep benefits, make ends meet, buy extras, or supplement inadequate savings). But the majority continue working because they enjoy it, they want to stay active and involved, pursue an opportunity, or try a new career.

The Trick

If we are working well into our 70’s or 80’s, it appears we haven’t left much time to enjoy what we used to think of as a retirement. But is this true? Can we enjoy a retirement as we continue to work? I believe we can, and it’s called The Retirement Trick, something I learned more than ten years ago from Dan Sullivan at The Strategic Coach.

Do this:

- Start with a piece of paper and a pencil for a five-minute brainstorming session with yourself.

- First, spend only two minutes writing down all the things you would do more IF ONLY you were retired right now. Don’t censor yourself. Don’t pay attention to any obstacles that pop up in your mind. Just let yourself list the things you would really want to do more during your retirement years.

- Next, spend two more minutes writing down all the things you would do less IF ONLY you were retired right now. Again, don’t censor yourself or pay attention to reasons why something won’t work.

- Reviewing your list of things you would be doing more of and things you would be doing less of, circle one item in each of the two lists. Maybe you will circle an item because it is easy to accomplish, or it carries the fewest obstacles in your mind, or it’s important to you. That’s your call.

- Now ask yourself the question: why wait until retirement to make these things happen? Think of an action step you can take right now to move in the direction of making each circled item happen.

You’ve told your brain what you want to do more of and what you want to do less of, beginning NOW, and you will have started a sequence of events that will move you in that direction. Over time, as if by magic (but it’s not), you will experience “retirement” even while you work. A trick that works!

Jeff

FORWARD LOOKING STATEMENT DISCLOSURE

As a Registered Investment Advisor, one of our responsibilities is to communicate with clients in an open and direct manner. Insofar as some of our opinions and comments are based on current advisor expectations, they are considered “forward-looking statements” which may or may not be accurate over the long term. While we believe we have a reasonable basis for our comments and we have confidence in our opinions, actual results may differ materially from those we anticipate. You can identify forward-looking statements by words such as “believe,” “expect,” “may,” “anticipate,” and other similar expressions when discussing prospects for particular events and/or the markets, generally. We cannot, however, assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Further, information provided in this letter should not be construed as a recommendation to purchase or sell any particular security.

The Planner’s Edge®: TM & copyright 2013. All rights reserved. No part of this publication may be reproduced in any form, or by any means whatsoever without written permission from the publisher. Serious Money TalksTM is a trademarks of The Planner’s Edge®. If you would like further information about the services of The Planner’s Edge®, please call 206-232-4500 or 1-800-735-7302. Email: info@theplannersedge.com.