A couple of months ago I wrote about digitization, the process of converting something into binary code that can be read by a machine. This process is happening everywhere and to virtually everything. It cannot be stopped or avoided. Anything that can be digitized will be digitized.

So what happens after something is digitized?

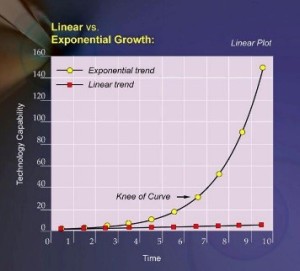

What happens next is a growth process that travels along an exponential curve with zero additional cost per unit (think Craigslist). This is in contrast to the growth pattern of non-digitized things, which is linear and has an additional cost of producing each new unit (think Seattle Times classifieds).

Importantly, exponential curves start out deceptively. They look a lot like linear growth curves (see image above) during the early time periods because there’s not much difference between growing 1-2-4 (exponential) and growing 1-2-3 (linear).

But once a digital technology catches on, its growth virtually explodes because now it goes to 8-16-32-64-128. This completely disrupts the business models and industries being replaced (think cell phones vs. landlines).

In fact, in short order disrupted businesses and products actually dematerialize and become obsolete and vanish. Remember how CDs made videotapes obsolete? Then DVDs did the same to CDs? And now that Netflix is a download service, it has made its own red envelopes vanish, along with its competitors, Blockbuster and Hollywood Video.

There are many other examples of dematerialization from our daily life: Skype is currently dematerializing long-distance phone service. ITunes has effectively dematerialized record stores. Amazon has dematerialized Borders Books. And smartphones have effectively dematerialized everything from personal cameras and boom boxes to tape recorders, AAA Triptiks, alarm clocks, calculators, and photo albums, plus dozens more.

After a new digitized product or service has disrupted and dematerialized its predecessor, it becomes demonetized. This means that the cost to purchase or use the product or service is effectively or actually zero. Craigslist is free; Skype is free; the calculator on my smartphone is free; my photos are free. The trend toward demonetization means that old business models won’t continue to work, and it is incumbent on the new digitizer to create new business models that will generate revenue and profits. Think about how normal it feels to do business with Skype, Amazon, iTunes, ebay, Google, and craigslist.

There is something that happens to a product or service after demonetization; namely, it become available or accessible to all. That is, it becomes democratized. This explains, for example, why Africa is estimated to have over 1 billion mobile phones by 2016 when there were zero mobile phones in 2000.

The 6-D exponential growth process explains and helps to forecast so much of the incredible changes we have the privilege of experiencing during our lifetimes. In summary, the six Ds are: (1) Digitization, (2) Deception, (3) Disruption, (4) Dematerialization, (5) Demonetization, and (6) Democratization.

As digitization is changing our personal consumer lives so dramatically, so is it changing our health care industry, our energy industry, our education industry, and our agriculture industry. Because these industries are digitizing we can expect the changes to continue along an exponential growth path, disrupting many business models in its path, and creating new business models to which we will all (have to) adapt.

FORWARD LOOKING STATEMENT DISCLOSURE

As a Registered Investment Advisor, one of our responsibilities is to communicate with clients in an open and direct manner. Insofar as some of our opinions and comments are based on current advisor expectations, they are considered “forward-looking statements” which may or may not be accurate over the long term. While we believe we have a reasonable basis for our comments and we have confidence in our opinions, actual results may differ materially from those we anticipate. You can identify forward-looking statements by words such as “believe,” “expect,” “may,” “anticipate,” and other similar expressions when discussing prospects for particular events and/or the markets, generally. We cannot, however, assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Further, information provided in this letter should not be construed as a recommendation to purchase or sell any particular security.

The Planner’s Edge®: TM & copyright 2013. All rights reserved. No part of this publication may be reproduced in any form, or by any means whatsoever without written permission from the publisher. Serious Money TalksTM is a trademarks of The Planner’s Edge®. If you would like further information about the services of The Planner’s Edge®, please call 206-232-4500 or 1-800-735-7302. Email: info@theplannersedge.com.