“I must state at the outset that I have no idea when the next correction will occur. This piece does not constitute a prediction that the current uptrend is about to end—only that will end.

“I must state at the outset that I have no idea when the next correction will occur. This piece does not constitute a prediction that the current uptrend is about to end—only that will end.

Jeffrey Ross, Serious Money Talks, December 2013

Our December 2013 newsletter raised the topic of Lifeboat Drills, a discussion to help prepare us for the next inevitable correction in the markets. As my quote above from that newsletter indicated, I wasn’t predicting a correction, but little did I know how soon the Drill would be put to the test.

In fact, about one week after we emailed the December newsletter to you the market began to decline rather precipitously on January 23rd. As the market fell about 5%, as predicted, the conversation of business pundits turned to the “bleaker times ahead.” Hopefully, for those of you who read the December newsletter, the Lifeboat Drill provided perspective and comfort during this decline.

As I explained, the most important takeaway about declines or corrections is that they end—they always end. This decline was no different, reaching a bottom on February 5th, just 14 days later. And, as of the date of this writing, the market had fully recovered from its decline in just another 14 days.

In this issue I want to add another big takeaway to our understanding of market corrections: every year contains some periods of negative returns, even the years where the market has strong up years. Another way of stating this is that in order for you to receive the long-term positive returns that come with your investment portfolio, you must expect to experience the worries that accompany market corrections—not just occasionally, but every year.

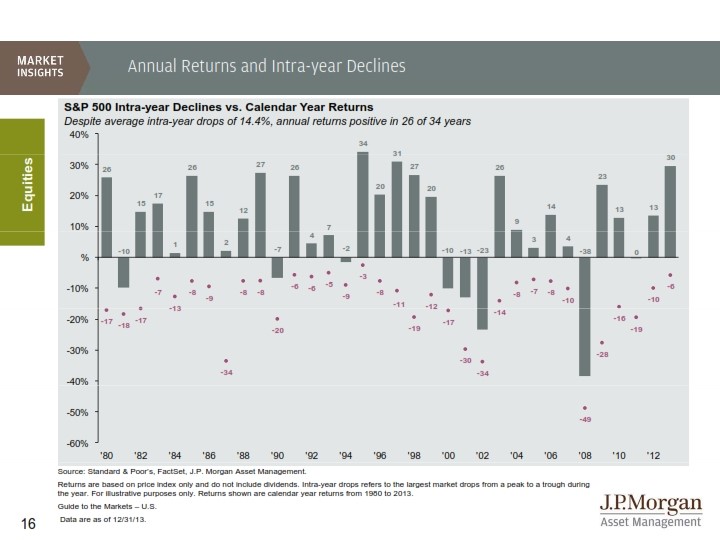

Thanks go to JP Morgan for providing data at the top of this post. The chart documents this takeaway. The chart is a little busy but does illustrate a number of important concepts for the long-term investor:

- Let’s start with the sub-title of the chart: even though the average year experiences a decline at some point during the year of 14.4% the market still showed positive returns 76% of the time (26 out of 34 years) since 1980. Winning 76% of the time at almost anything is pretty darn good.

- No year was immune from a negative period. So negative periods just simply come with the territory.

- Even really good years like 1980 (+26%), 1995 (+ 34%), 2003 (+26%) and 2013 (+30%) experienced negative intrayear declines: -17%, -3%, -14%, and -6%, respectively.

- At the risk of belaboring this point: every intrayear decline ended at some point. This point can’t be overstated and needs to be remembered every time the market begins and sustains a downward slide. Because it is during this slide that the news takes on more negative tones than usual, the prognosticators increase their forecasting of doom and gloom, and investors begin to wonder if “this time is different”.

FORWARD LOOKING STATEMENT DISCLOSURE

As a Registered Investment Advisor, one of our responsibilities is to communicate with clients in an open and direct manner. Insofar as some of our opinions and comments are based on current advisor expectations, they are considered “forward-looking statements” which may or may not be accurate over the long term. While we believe we have a reasonable basis for our comments and we have confidence in our opinions, actual results may differ materially from those we anticipate. You can identify forward-looking statements by words such as “believe,” “expect,” “may,” “anticipate,” and other similar expressions when discussing prospects for particular events and/or the markets, generally. We cannot, however, assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Further, information provided in this letter should not be construed as a recommendation to purchase or sell any particular security.

The Planner’s Edge®: TM & copyright 2013. All rights reserved. No part of this publication may be reproduced in any form, or by any means whatsoever without written permission from the publisher. Serious Money TalksTM is a trademarks of The Planner’s Edge®. If you would like further information about the services of The Planner’s Edge®, please call 206-232-4500 or 1-800-735-7302. Email: info@theplannersedge.com.