“The business of journalism is to sell news everyday even when there is no news of consequence.”

Nick Murray, 1993

It is very easy (in fact, too easy) to fall into the trap of thinking that what we hear on the news is the only news that really matters to our lives or our investments, or that the latest government policy is what really matters to our lives and our investments. But is the daily news or the latest government policy really the big picture, or is there something bigger out there?

In past newsletters and in many client conversations, I have theorized and stated that companies are more important than countries or governments, suspecting that this is the reason why the stock market has performed so well during the past 5 years of turmoil, division, and growing problems.

I still think this is true, especially after attending a two-day conference in Los Angeles called Abundance 360, conducted by the organization headed by Peter Diamandis, author of the book, Abundance. Pun intended, there was an abundance of information about the true big picture impacting our lives, our investments, and in fact the entire globe. What is this big picture? In a single word: DIGITIZATION.

Digitization (which is process of converting something into bits of information containing 0’s and 1’s) begins a sequence of events that ultimately disrupts entire industries, resulting in things being cheaper, faster, more convenient, and in most ways, better. The sequence of events following digitization appears, at first, to be unfolding very slowly. But, in fact, the sequence is unfolding at an exponential pace, a pace that doubles regularly.

Understanding that anything that is digitized has the opportunity to grow exponentially is the key to understanding the big picture. Because it is difficult to conceptually understand the power of exponential growth, I want to provide two illustrations.

First is a theoretical explanation: If you were to take 30 linear paces you would travel approximately the distance from home plate to first base on a baseball diamond. However, if you were to take 30 exponential paces you would travel 26 times around the earth! This is because with each pace equal to about 1 yard, the second pace would be 2 yards, the third pace would be 4 yards, the fourth would be 8 yards, the 10th would be 1024 yards, the 20th would be 1,048,000 yards, and the 30th would be almost 1.1 billion yards.

Second is a real-life explanation: As exponential growth reaches a tipping point products and industries literally vanish and are replaced with their digital equivalents which are faster, cheaper, better, easier, and more convenient. Think about the smartphone in your pocket, and look at the picture at the top.

The picture highlights what exponential growth looks like in your pocket. All of the items in the picture essentially have been dematerialized—i.e., made obsolete, replaced by a tiny device processing bits of digital information at virtually zero cost. And, remarkably, because the digital bits in your smartphone are free, they are available to the entire world free of cost.

By the way, smartphones aren’t the end of the line. New last year were smartwatches. Next year, who knows?

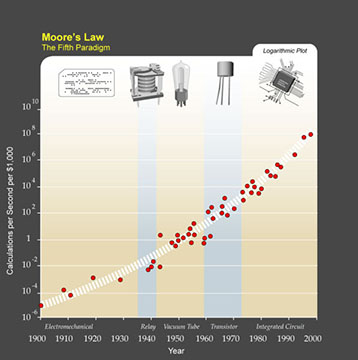

One lesson I learned at the conference that I want to pass along to you is this: the trendline of exponential growth in our world has grown steadily since 1900, completely independent of world wars, poor government policies, political parties, and other societal pitfalls. In other words, this is a trend we have been able to observe and count on and will be able to do so in the future as well. In still other words, this trendline is really the bigger picture.

The illustration above shows the number of calculations per second that $1000 has been able to buy over time. Beginning in 1900, when we had electro-mechanical methods of calculating, we have seen relay systems replacing electro-mechanical, vacuum tubes replacing relay systems, transistors replacing vacuum tubes, and now integrated circuits leading our progress. Notice that this path of human progress was not impeded by any of the events and circumstances we tend to think about as hallmarks of the twentieth century.

I am planning to share more information from this conference throughout the year. For now, though, keep in mind that the trend of global exponential growth is really the big picture.

Jeff

FORWARD LOOKING STATEMENT DISCLOSURE

As a Registered Investment Advisor, one of our responsibilities is to communicate with clients in an open and direct manner. Insofar as some of our opinions and comments are based on current advisor expectations, they are considered “forward-looking statements” which may or may not be accurate over the long term. While we believe we have a reasonable basis for our comments and we have confidence in our opinions, actual results may differ materially from those we anticipate. You can identify forward-looking statements by words such as “believe,” “expect,” “may,” “anticipate,” and other similar expressions when discussing prospects for particular events and/or the markets, generally. We cannot, however, assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Further, information provided in this letter should not be construed as a recommendation to purchase or sell any particular security.

The Planner’s Edge®: TM & copyright 2013. All rights reserved. No part of this publication may be reproduced in any form, or by any means whatsoever without written permission from the publisher. Serious Money TalksTM is a trademarks of The Planner’s Edge®. If you would like further information about the services of The Planner’s Edge®, please call 206-232-4500 or 1-800-735-7302. Email: info@theplannersedge.com.